Our HHR is nine years old, ten in just a few more months. We have had it since March 2011, and in nearly eight years, we have put on around 90,000 miles, with the most miles put on in the first 13 months of ownership as I was driving back and forth from Arkansas to Florida a few times each month when Marcia was not staying in Arkansas with me after we got married. Our auto insurance has been with the same company all that time…never had a claim, never had an accident, never had a ticket (or even pulled over). Yet our car insurance has more than tripled during this same time period…with largest increases these past two years and for the upcoming year. Well…time to look into this…

The Internet is great for finding car insurance quotes. However, amazingly so…I did not even give it a try. Why? Just did not want to deal with the massive amounts of phone calls this would produce, and because they are out to sell ‘cheap’ insurance, and I wanted good coverage at a good rate. So I turned to our motorhome insurance company.

We have used Diversified Insurance Management ever since we had our first motorhome in November 2011. We like both of the insurance companies that they hooked us up with. Blue Sky took care of our “Storage Fire” incident with pure professionalism, and a fair settlement. Last year in September Diversified informed us that Blue Sky was no longer going to offer motorhome insurance coverage to us because their underwriter, RLI, "...made a significant corporate decision to discontinue providing insurance policies for recreation vehicles...decisions like this are not uncommon..." They found us an equally good company, Foremost, and we have been happy with them. In fact, even with the change in companies, our costs are essentially the same as back in 2014. So I contacted Sarah, our contact person, and asked about auto insurance. She gave me a quick quote with Progressive, without all the facts as to where we live (since we store the motorhome off site all she had was our PO Box), and it looked pretty good. However, after she put in our Holiday Florida address, it was still 1/3 less expensive than our current insurance company…but I wasn’t sure it was going to be the best.

Marcia has been using Brown & Brown Insurance for her insurance needs for a few decades. They are our agents for our condo insurance through Citizens (State of Florida owned Insurance Company) and our flood insurance through Wright Insurance. So I contacted them via email late yesterday afternoon, and today Hamlet, a nice lady who works under our primary agent Rick, provided a quote from Auto-Owners Insurance. This quote is like 1/3 our current price, and includes $100,000 per person, $300,000 per accident for liability coverage, and a $500 deductible on our car which, frankly, would probably be totaled in anything but a minor accident. There are a few other things…but good coverage, and equal coverage to what we sought with Progressive. Another thing, currently we pay monthly…we will now pay every 6 months via credit card.

The difference being…Brown & Brown are here in Florida and deal with Florida related insurance companies. Auto-Owners is actually in Michigan…but they cover insurance for Florida. Florida has some stipulations with insurance companies…for instance, front window glass replacement can have no deductible attached to it. Florida Statute 627.7288 requires auto insurers in Florida to replace or repair their policy holders damaged windshield with zero deductible, or, in other words, for “free.”

I guess you all know how we feel about this change…

Yes, it has been 10 days since my last blog post. We have been weathering the heat, enjoyed a bit cooler temps on a few days and nights, and in another few weeks I think the majority of hot humid weather is behind us. Hurricane season is all but behind us now.

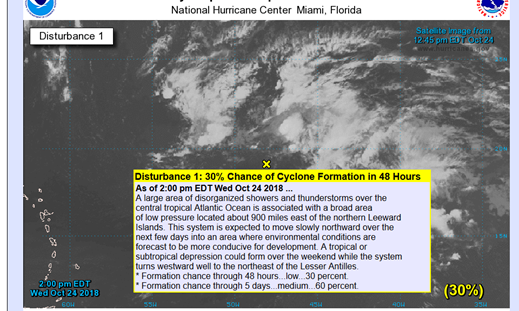

This being the first time being in Florida during Hurricane Season, the National Hurricane Center has been my go to place to watch for possible problems. Today there is just one situation in the Atlantic, it is moving north, and has a small chance of becoming anything, and even smaller chance for us to have to worry about it.

Other than a quick trip up to South Carolina for something…we have not been doing to much around here.

Just a JOKE mom, not a lie…

We didn’t win, but did get 2 numbers.

(Maybe the Powerball will pay off…)

I really need to go over all my insurance too. It's just such a pain in the butt!!!

ReplyDeleteWhen I canceled our current auto insurance yesterday effective November 1st the guy I spoke to was very nice, and said, and quote, "I have been with [named company] for six years, and I have changed my personal auto insurance three times in six years." Those who "shop around" will find good deals. This is something that Brown & Brown will do for me whenever I need it, so it is a good move on our part...and we literally save well over $1,500 per year...yes, THAT much money.

DeleteWhen we changed our address from Sioux Falls to the Black Hills of SD our insurance doubled. Apparently the hail storms in the Black Hills account for a lot of broken windshields. We took off our glass replacement and our insurance dropped by $700.

ReplyDeleteJim/Barb: Florida has mandatory glass replacement "if" you have collision...front windshield only. I am very surprised how much we saved...like going back in time to 2011 when we bought it. Love your blog, by the way, hunting, fishing, farming and building...wow.

Delete