Here I thought the “Days of Banking Rip offs” was over…apparently not. You wonder if “THEY” will ever learn their lesson…I think not. Here’s our story…

The story starts when we decided to sell this house and move into the condo back in 2013. The house was paid for, the condo was not…worse yet, the condo was upside down at the time. We ‘could’ have paid the condo off with the money gained from the sale of the house…but at the time we wondered if we might be better off just turning the condo back to the bank. However, in 2012/2013 the bank did reduce the principle owed on the condo due to the new federal regulations, so we were not that much upside down…but still upside down. The condo was, at the time, a business investment for Marcia from way back in 2007 or early 2008. Of course, we all know about the crash of 2008, hence, the condo was upside down.

Due to the condo being an investment, we needed to live in it for at least two years before it could be considered our home, and not an investment anymore. So I suggested that we pay above and beyond the normal mortgage payment…and now, in 2017, we are not upside down…or if we are, not by much. We also decided to continue to live here…it has its advantages for us. Nice neighbors, well protected, not too bad of a HOA monthly fee. Hence, we upgraded the floor, and over the next two years, we will upgrade the kitchen, give it some paint, and upgrade the bathroom counter, etc. We are going to pay for this by…not paying interest any more, which means, paying off the condo. By setting the same amount of money aside each month as we currently pay in mortgage payments, it will pay for the upgrades…and we will not be tossing a few thousand away in interest payments anymore.

So I made the call to the bank, a MAJOR BANK, one of the ones listed in the first cartoon image in this blog…ok, Chase Bank, there you go. Despite having a statement which says, “this is how much your owe on your mortgage, but if you wish to pay it off, call and get a quote”, I do call, and they want a few hundred more dollars for interest than what the 5 day old statement says. Ok, I get that…they want their interest up to the day you pay it off. But then she says that it will take a month to get the paper work saying it is paid off, and another 4-6 months before we get the paperwork which can taken to the county to show it is paid off (closing stuff). So we thanked her for the information, and I digested the information. I did not like having that important paperwork sitting in our mail because we leave here in mid-April…I did not like the 4-6 months for the more important paperwork just sitting around. I got cold feet….even though we had transferred enough money from our Money Market account to the Checking account to pay the condo off and pay for the new floor (which ended up costing $1,000 more than we first planned on). Then, I did the math. If we paid around 90% of it off, the interest would fall to around $25 per month. We can continue paying our current accelerated amount, and when we get to California in September, we can get a payoff amount, go to a local Chase Bank and write them a check. In the meantime, we can put some money back into the money market so it can earn another $10 or so before we decide to use it.

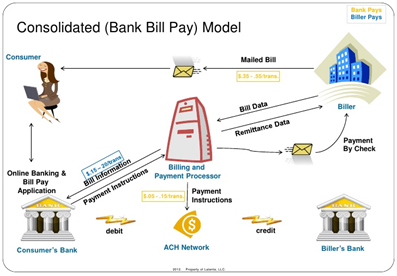

Of course, we are big time “Bank Bill Pay” people…the only time I write a check out is for the IRS, and for some camping sites, especially National Park, National Forest Service, etc type of sites. Heck, last year as I was about to put my first IRS check in the mail (I write out each quarterly check ahead of time after I we do our taxes so they are ready to go) I noticed I wrote each check wrong…leaving out the “Tens” area when I wrote out the amount. (Like, putting $585.00 in the amount, but writing out “Five hundred dollars and no cents”, leaving out the ‘Eighty Five’ part.) Ok, so now comes the part where the BIG BANK becomes the crook. I go online with our bank, and change the monthly total to be paid to our Chase Mortgage to the 90% amount of the payoff. It is rescheduled to go out on Friday, the 17th.

On Friday night I look, and our bank has sent out the money…but with it being such a large amount, they decided to actually send a physical check instead of just a wired check. The computer says, “The balance will be deducted when cashed.” Ok, so the waiting game starts. Monday, still not cashed. Monday night, still not cashed. Tuesday, still not cashed. Tuesday afternoon, still not cashed. Tuesday night…BINGO, it is cashed. All the while, I am also going to Chase site to see if it has been credited. Finally, on Tuesday night, yes, it has been credited…and this is where the THIEVERY takes place.

Payment was due April 1st. For April, they accept the normal principal payment, they accept the normal interest, and then there is this “FEE” for an amount which equals the principal and the interest. Then they take a payment for May out of that “fee amount” for a slightly higher principal amount than April and for the a slightly smaller amount of interest than April, as “IF” we made another normal payment for May. Then, after each of these amounts have been deducted from the total check, the rest is finally posted as a Principal Payment, and that our next payment is not due now until June 1st. They are STEALING a whole extra month’s of interest from us! Well, at least they tried to steal it.

So I call them this morning, and first thing I ask is, “Where are you located?” The lady says from overseas. I asked politely if we might be transferred to a person in the states because we needed to talk to someone whom we could clearly understand while we discussed our issue. She politely said ok, and transferred us to a nice lady in Ohio. So I explain the situation, and this nice lady immediately gives the “corporate line” of “when our computer receives a payment which is over…” So I ‘not so politely’ shoot that line down by saying, “If you look at the history of our account, we have paid more than the required amount for over three years now, and you computer always put the extra towards the principal.” And if that wasn’t enough, I added, “Let’s just suppose that we had $100,000 in your bank…and we went into the bank today to withdraw that money, but we insisted on being paid interest for April and for May even though we are taking out the money in March…” A bit of silence, and then an acknowledgement that things were not done correctly (I felt like saying, “Oh, it was done correctly by bank standards, but not ethically correct…” but I held my tongue on that one.) Twenty five minutes later, it was all straightened out. And I only insulted Chase (calling them thieves, crooks, taking advantage of the elderly, etc.) a few times. I did end on a positive note telling the young lady that I know she did not do this, and that she handled the situation very well. She said, “No sir, we were wrong, it is fixed now…we are sorry.” Yea, more corporate talk…if you get caught with your hand in the cookie jar, repent. But as Marcia say, “If you don’t get caught with your hand in the cookie jar, they will take every cookie they can…” After all, this is not the “FIRST TIME” we caught Chase with their hand in the cookie jar…shortly after we got married Marcia had made a payment towards principal and Chase took that payment, created into three normal payments with the rest going toward principal, putting us three months ahead on our payments. When they were caught doing that, they assured us that ANY part of a payment in the future which was over the normal payment amount would go toward Principal. You wonder if “THEY” will ever learn their lesson…I think not.

Good thing you caught that!

ReplyDeleteI have a similar story, though not a bank or a large payment, but friends of our bought furniture from one of those places that advertises no interest for so many months. They set it up to pay it off within that time frame. This was awhile ago so they had a coupon book with a slip to send in with the payment every month. As the time was winding down they checked the payment book and found that there was one payment after the time period expired which would have meant that they would have had a whooping interest payment. They doubled up their payments and didn't have to pay the interest but you really have to be careful when money and business is involved!

Lots of skummy things out there...one would think our well regulated banks would be different.

DeleteI'm sure that's a BANK policy that puts lots of cash in their pocket because most people never figure out what happened. They just let it go. Good for you for making them correct it!!!!

ReplyDeleteSo right Nancy, they 'have' to be making money off of this policy or they would not do it. I hope that when Chase goes through an audit, that our account is part of that audit so that they can see what this bank is doing. We are still considering filing a complaint to the Feds...just have not decided upon that route yet.

Delete